It can be a sole proprietorship, partnership, corporation, LLC, or any other legal structure recognized by the government. Moreover, the business entity concept promotes transparency and accountability in the business world. It ensures that businesses are held responsible for their actions and obligations, and that their financial statements are reliable and trustworthy. This is particularly important for investors, creditors, and other stakeholders who rely on accurate and timely financial information to make informed decisions. By adhering to the business entity concept, businesses can build trust and confidence among their stakeholders, which ultimately contributes to a strong and stable economy.

- Different departments may be considered business entities (say units) such that their performance is measured as if they are stand-alone entities.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Understanding these dynamic aspects is crucial for accurately representing entities in various contexts.

- This will keep a fair accounting record of the business as well as compliance with the taxation and regulatory requirements.

Taxation Differences

Additionally, corporations are typically subject to higher setup costs and more government regulation. The business entity definition is an organization founded by one or more natural persons to facilitate specific business activities or to allow its owners to engage in a trade. Globalization, changing tax laws, and emerging industries bring new complexities. The concept adapts by requiring businesses to stay informed and adjust their financial practices accordingly. Think of it as your financial compass, guiding you through ever-shifting regulatory landscapes. Regularly reconcile your bank statements and credit card records with your accounting software to ensure everything matches up.

What is the relationship between owners and business entities?

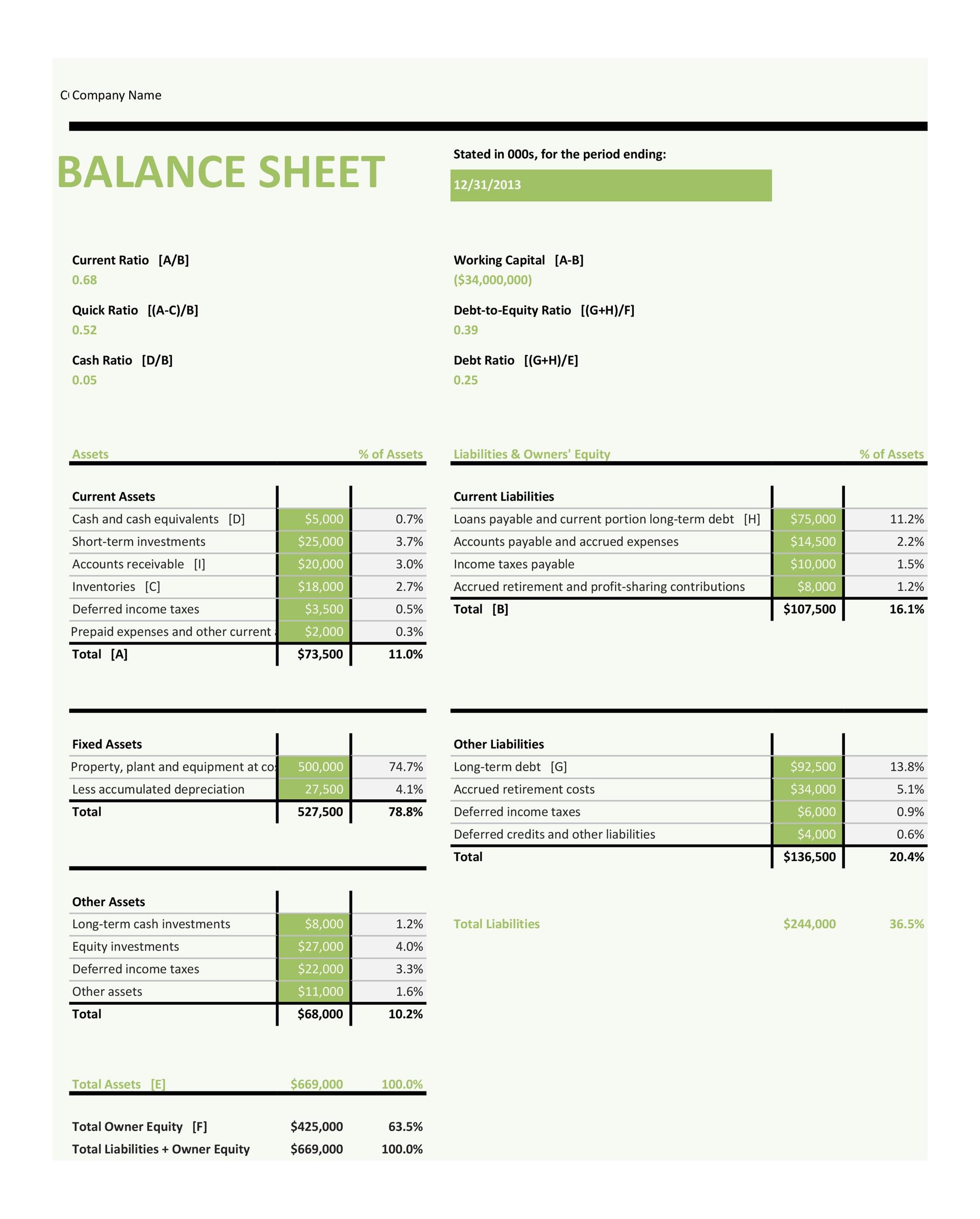

Business entities are often subject to taxation, so the business owners must file a tax return for those businesses. A sole proprietorship is an unincorporated business with one owner or two owners who are married. This is the default entity if you start a business, and if you’re the only owner. You don’t have to register it with your state, but you may have to obtain a business license or permits, depending on the type of business you’re conducting. He has setup a single-member accounting practice and uses one room for the purpose of business.

Owner’s Personal Finances:

It compels the business and owner to be responsible for their separate financial obligations. New businesses should opt for types of business entities that have a low cost and give the opportunity to manage it easily. It is also important to consider types of business entities that provide limited liability in order not to become fully responsible for debts incurred by your company. This means that types of business entities include C-corporation, S-corporation, and limited liability companies.

How it’s structured affects how taxes are paid and how liabilities are determined. Business entities are created at the state level, often by filing documents with a state agency such as the secretary of state. It’s about fostering a culture where everyone understands and upholds financial boundaries. This adaptation involves clear communication, internal controls, and ethical practices to safeguard the business’s financial integrity. Think of it as building a culture of financial stewardship where everyone plays a role in maintaining financial accountability. From basic bookkeeping applications to enterprise-grade solutions, find a tool that aligns with your business needs and automates tedious tasks.

Which of these is most important for your financial advisor to have?

The business entity concept is a foundational principle in accounting standards globally, ensuring consistency and reliability in financial reporting across different jurisdictions. Real-time financial data analysis will become crucial for informed decision-making. The business entity concept will integrate with data analytics tools, enabling businesses to track performance, identify trends, and optimize financial strategies in real time.

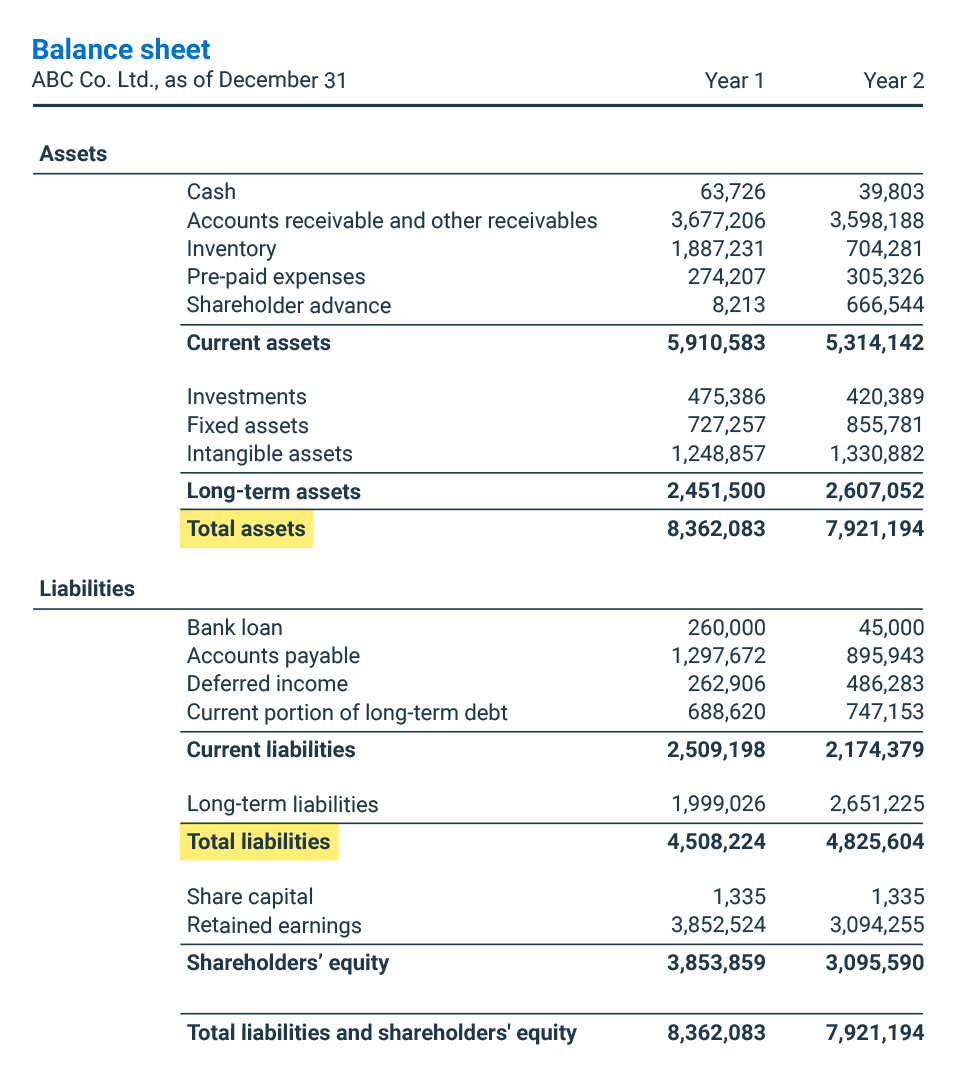

This separation ensures that business transactions and financial records are accounted for separately from the owner’s personal assets and liabilities. In conclusion, the business entity concept is a fundamental principle in accounting that treats a business as a separate entity from its owners. Understanding and applying the business entity concept is essential for maintaining transparent and reliable financial records, thereby supporting informed decision-making by stakeholders in the business. Under the business entity concept, the business’s and its owners’ financial position are treated as separate entities. This means that the business’s assets and liabilities are not the same as those of the owners. Therefore, any business expenses or additional capital injected into the business are recorded separately from the owners’ personal expenses and income.

Types of business entities can be changed if they are no longer suitable for your company. This means that types of business entities should always fit the needs and goals of a particular enterprise regardless of any changes in its situation or environment, including legal requirements. Corporations offer shareholders limited liability, and employees can enjoy etf vs mutual fund tax benefits, such as health insurance. Corporations also have perpetual existence, allowing ownership to be passed down to future generations through existing shareholders. Business entity concept is one of the accounting concepts that states that business and the owner are two separate entities and therefore, should be considered separate from each other.