For example, all the debtors of an organisation are grouped together under just 1 head of sundry debtors in the balance sheet. Similarly, Inventory shows the net total of Raw Material, Work In Progress and Finished Stock. This presentation starts with assets and after that, equity & liabilities are listed. The format is categorized into sections that are in descending order of liquidity, which means prioritizing items that are less liquid in nature.

Resources

Stock investors, both the do-it-yourselfers and those who follow the guidance of an investment professional, don’t need to be analytical experts to perform a financial statement analysis. Today, there are numerous sources of independent stock research, online and in print, which can do the number crunching for you. However, if you’re going to become a serious stock investor, a basic understanding of the fundamentals of financial statement usage is a must. This guide will help you to become more familiar with the overall structure of the balance sheet.

- Investors and creditors generally look at the statement of financial position for insight as to how efficiently a company can use its resources and how effectively it can finance them.

- For example, a company with substantial assets and a low debt-to-equity ratio will likely be deemed creditworthy, making securing favourable terms and interest rates on loans easier.

- The balance sheet of Apple (AAPL), a global consumer electronics and software company, for the fiscal year ending 2021 is shown below.

- For example, you can use a balance sheet to determine what your quarterly figures must be in order to beat your previous year’s profits.

A Crucial Understanding

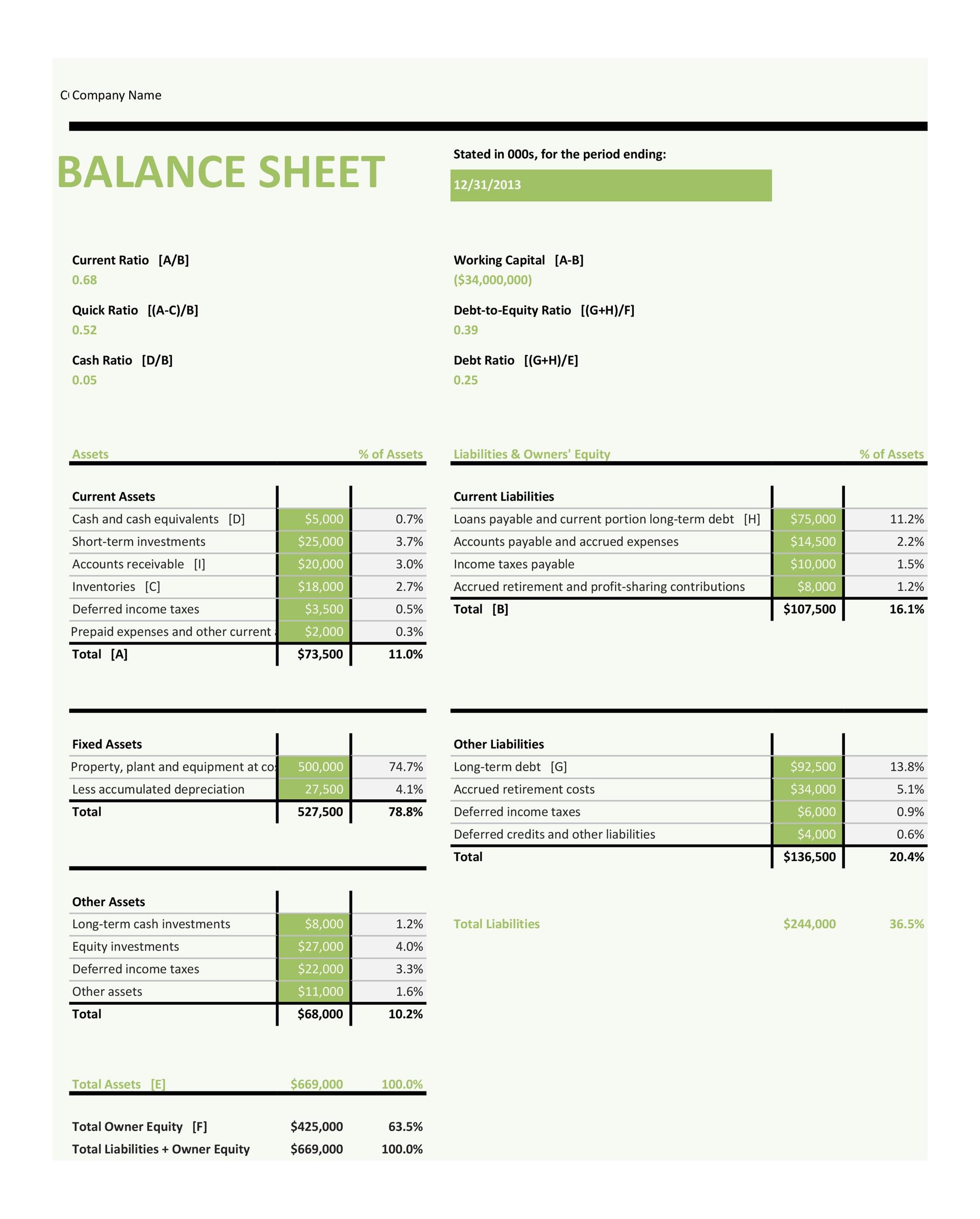

Assets can be classified based on convertibility, physical existence, and usage. Bill’s quick ratio is pretty dire—he’s well short of paying off his liabilities with cash and cash equivalents, leaving him in a bind if he needs to take care of that debt ASAP. She’s got more than twice as much owner’s equity than she does outside liabilities, meaning she’s able to easily pay off all her external debt.

Hiring an Accountant: Before and After

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond.

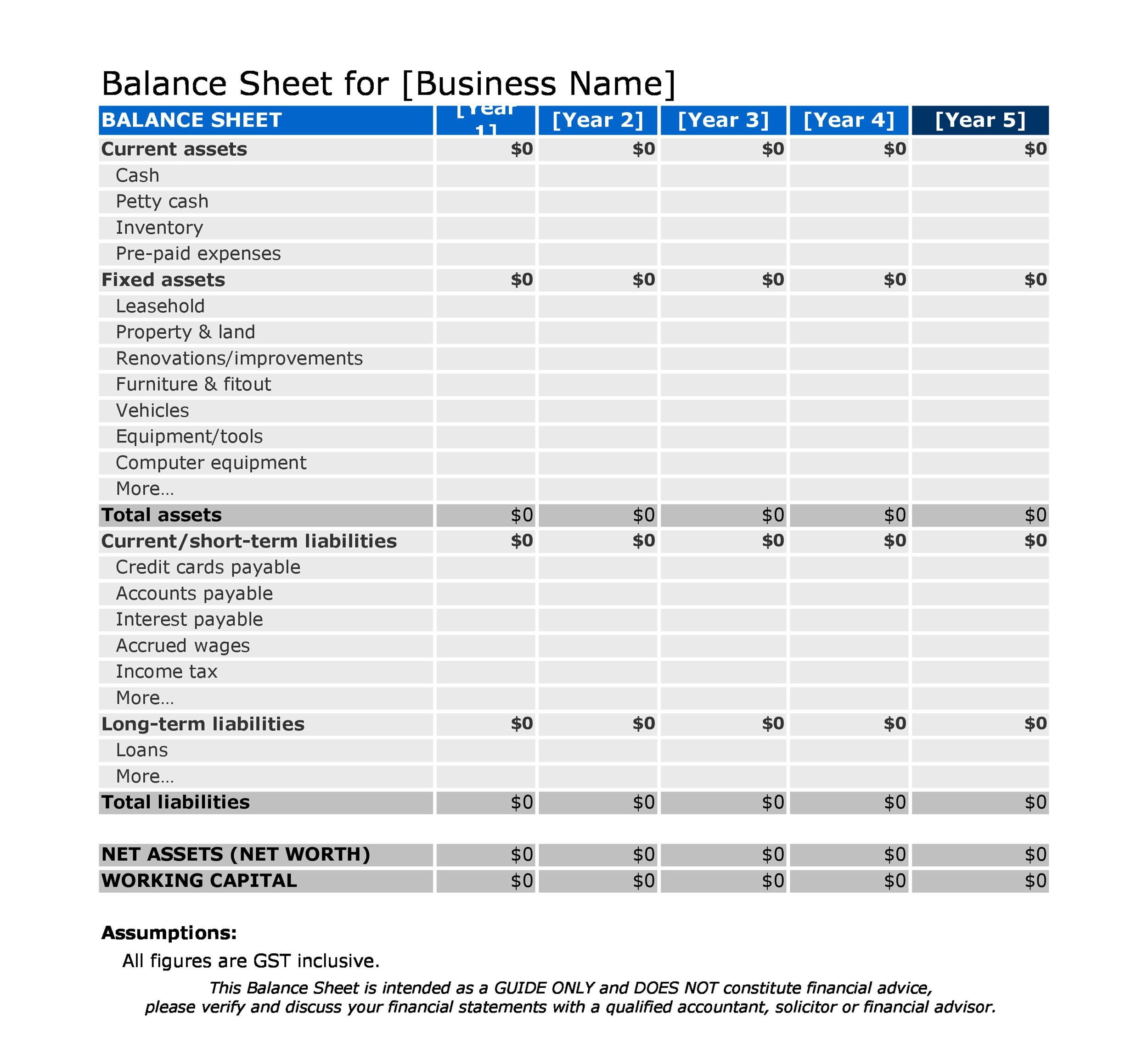

Pro Forma Balance Sheet Template

If the WCR is positive, this means that the company has little or no trade payables, but does have stock and trade receivables. In this case, it may be a good idea to review customer follow-up and sales management. Now that we have explored the parts of a balance sheet, let’s figure out how it works. A dividend might be reported as the contract to retain earnings, or sometimes recorded as the net off retain earnings.

For instance, if someone invests $200,000 to help you start a company, you would count that $200,000 in your balance sheet as your cash assets and as part of your share capital. This may include accounts payables, rent and utility payments, current debts or notes payables, current portion of long-term debt, and other accrued expenses. These revenues will be balanced on the asset side of the equation, appearing as inventory, cash, investments, or other assets. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years. It shows the balance of resources available once fixed assets have been financed. Income statements delineate a company’s revenue sources and expenditures within a defined period, illustrating the transformation of gross revenue into net profits.

It is helpful for business owners to prepare and review balance sheets in order to assess the financial health of their companies. The balance sheet only reports the financial position of a company at a specific point in time. After you have assets and liabilities, calculating shareholders’ equity is done by taking the total value of assets and subtracting the total value of liabilities. Assets are typically listed as individual line items and then as total assets in a balance sheet. Another difference is that the accounting balance sheet gives more detail, whereas the operating balance sheet does not.

A balance sheet depicts many accounts, categorized under assets and liabilities. Like any other financial statement, a balance sheet will have minor variations in structure depending on the organization. Following is a sample balance sheet, which shows all the basic accounts classified under assets and liabilities so that both sides of the sheet are equal.

Annie’s Pottery Palace, a large pottery studio, holds a lot of its current assets in the form of equipment—wheels and kilns for making pottery. You can improve your current ratio by either increasing your assets or decreasing your liabilities. This format is not ideal for both inter-firm and intra-firm comparisons because the information presented only relates to the current year. It is easier to compare the information in a vertical format balance sheet.

Your balance sheet can help you understand how much leverage your business has, which tells you how much financial risk you face. To judge leverage, you can compare the debts to the equity listed on your balance sheet. Leverage can also be seen as other people’s money you use to create more assets in your business. Balance sheets are one of the most critical financial statements, offering a quick contra asset account snapshot of the financial health of a company. Learning how to generate them and troubleshoot issues when they don’t balance is an invaluable financial accounting skill that can help you become an indispensable member of your organization. In practice, the balance sheet offers insights into the current state of a company’s financial position at a predefined point in time, akin to a snapshot.