This investigative approach ensures that corrective actions are targeted and effective. Direct materials actually cost $297,000, even though the standard cost of the direct materials is only $289,800. A material quantity variance is the difference between the actual amount of materials used in the production process and the amount that was expected to be used. The measurement is employed to determine the efficiency of a production process in converting raw materials into finished goods. Material quantity variance is favorable if the actual quantity of materials used in manufacturing during a period is lower than the standard quantity that was expected for that level of output.

Our Team Will Connect You With a Vetted, Trusted Professional

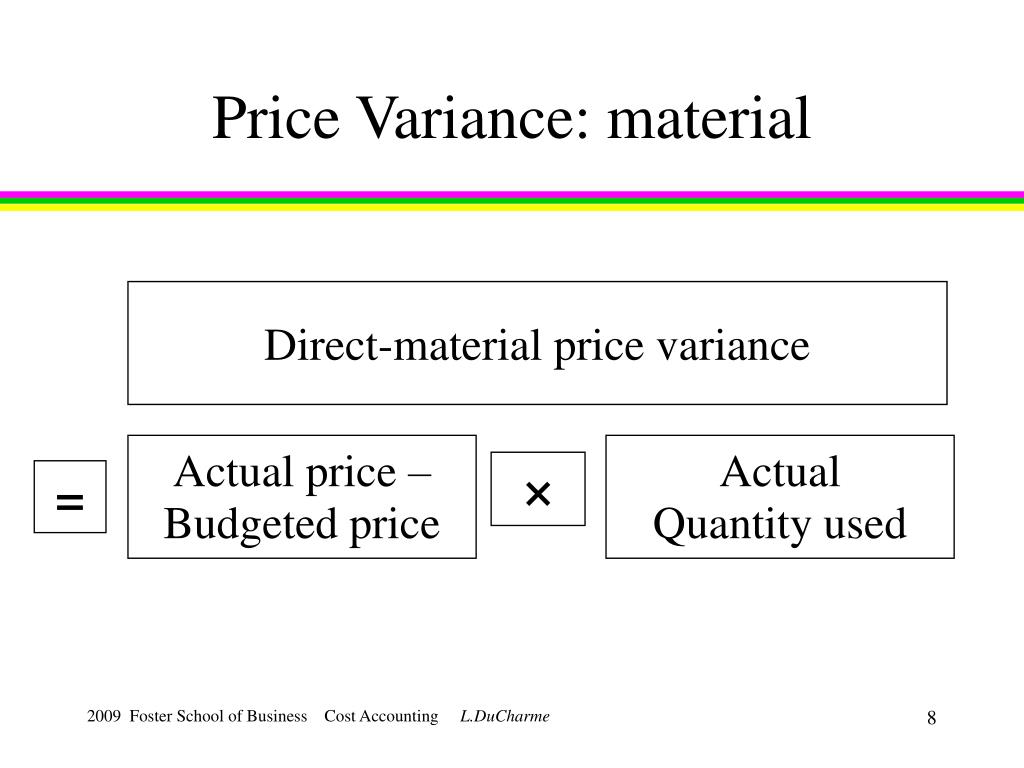

The term “purchase price variance,” or PPV variance, is used to show the difference between the estimated and actual costs in accounting. Direct materials price variance account is a contra account that is debited to record the difference between the standard price and actual price of purchase. Materials price variance represents the difference between the standard cost of the actual quantity purchased and the actual cost of these materials.

Great! The Financial Professional Will Get Back To You Soon.

The difference between this actual expenditure and the actual expenditure on direct material is the direct materials price variance. The standard price of materials purchased by Angro is $2.00 understanding taxes on life insurance premiums per kg and standard quantity of materials allowed to produce a unit of product is 1.5kg. Calculate direct materials quantity variance and also indicate whether it is favorable or unfavorable.

Formula of Direct Materials Quantity Variance Calculator

- An adverse or unfavorable material quantity variance occurs when the actual volume of materials used in production exceeds the standard quantity that is expected for the level of output in a period.

- The standard cost of actual quantity purchased is calculated by multiplying the standard price with the actual quantity.

- Understanding the factors that influence direct material variance is essential for businesses aiming to maintain control over their production costs.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- The term “purchase price variance,” or PPV variance, is used to show the difference between the estimated and actual costs in accounting.

This is because the actual price paid to buy 5,000 units of direct material exceeds the standard price. Direct material quantity variance is calculated to determine the efficiency of the production department in converting raw material to finished goods. A negative value of direct material quantity variance is generally unfavorable and it implies that more quantity of direct material has been used in the production process than actually needed.

Analysis

Like direct materials price variance, this variance may be favorable or unfavorable. If workers manufacture a certain number of units using a quantity of materials that is less than the quantity allowed by standards for that number of units, the variance is known as favorable direct materials quantity variance. On the other hand, if workers use the quantity that is more than the quantity allowed by standards, the variance is known as unfavorable direct materials quantity variance. To compute the direct materials price variance, subtract the actual cost of direct materials ($297,000) from the actual quantity of direct materials at standard price ($310,500). This difference comes to a $13,500 favorable variance, meaning that the company saves $13,500 by buying direct materials for $9.90 rather than the original standard price of $10.35.

This setup explains the unfavorable total direct materials variance of $7,200 — the company gains $13,500 by paying less for direct materials, but loses $20,700 by using more direct materials. Hence, the total material cost variance may result from the difference between the standard and actual quantities of materials used, the difference between the standard and actual prices paid for materials, or from a combination of the two. The following equations summarize the calculations for direct materials cost variance. For purposes of inventory calculation, the direct materials account includes the cost of materials used rather than materials purchased. To calculate direct materials, add beginning direct materials to direct materials purchases and subtract ending direct materials.

Direct materials quantity variance is a part of the overall materials cost variance that occurs due to the difference between the actual quantity of direct materials used and the standard quantity allowed for the output. Generally, the production managers are considered responsible for direct materials quantity variance because they are the persons responsible for keeping a check on excessive usage of production inputs. However, purchase managers may purchase low quality, substandard or otherwise unfit materials with an intention to improve direct materials price variance. In such cases, the responsibility of any unfavorable quantity variance would lie on the purchasing department. Irrespective of who appears to be responsible at first glance, the variance should be brought to the attention of concerned managers for quick and timely remedial actions. As is the case when analyzing other variances, the direct material price variance needs to be assessed in the context of other relevant variances and factors, such as direct material price variance and direct labor variances.

Total actual and standard direct materials costs are calculated by multiplying quantity by price, and the results are shown in the last row of the first two columns. When complete, capitalizable variances should be recorded in a “standard-to-actual” reserve within inventory on the balance sheet with the remainder being appropriately expensed through the income statement. This reserve has the effect of adjusting the company’s inventory balances to “actual,” which is appropriate under GAAP. On a net basis, the purchase price variance is really the difference between standard cost of the material and the actual invoice price of the material. The materials price variance can be computed either when materials are purchased or when they are placed into production. The standard rates calculated for batch and product level activities do not vary with production volume.

Conversely, issues such as late deliveries, substandard materials, or unexpected price hikes can lead to variances. Building strong relationships with suppliers and regularly evaluating their performance can help businesses anticipate and address potential problems before they impact production. Together with the price variance the quantity variance forms part of the total direct materials variance. For budgeting purposes, many companies determine a standard cost at the beginning of each year that is used as the estimated price of goods throughout the year.