Kayıt olmak için bir seçenek var ve bundan sonra oyunları oynamaya başlayabilirsiniz. Para yatırma ve çekme işlemleri günlük olarak işlenir ve sabırlı olmanız gerekebilir. Bununla birlikte, kazancınızı mümkün olan en kısa sürede almanızı sağlamak için her zaman mümkün olan en iyi hizmeti sunuyoruz. Futbol elbette kumarhanede tercih edilen spordur, ancak çok sayıda oyun ve etkinlik için MatadorBet Casino’da çevrimiçi spor bahisleri mevcuttur. Çevrimiçi kumarhane, müşteri sadakatini artırmanın güzel bir yolu olan ilk kez oyuncuları cezbetmek için özel teklifler ve promosyonlar sunar.

İster evde, ister işte veya sahilde olun, MatadorBet Casino haftanın 7 günü, günün 24 saati hizmetinizdedir. Elbette, mobil kumarhanemiz iOS ve Android çalıştıran mobil cihazların yanı sıra Windows ve Mac cihazlarda da mevcuttur. Dünyanın herhangi bir yerinde ve herhangi bir zamanda oynamak hiç bu kadar kolay olmamıştı. Tüm mobil casino oyunları Android, iOS, Windows ve hatta Blackberry için mevcuttur.

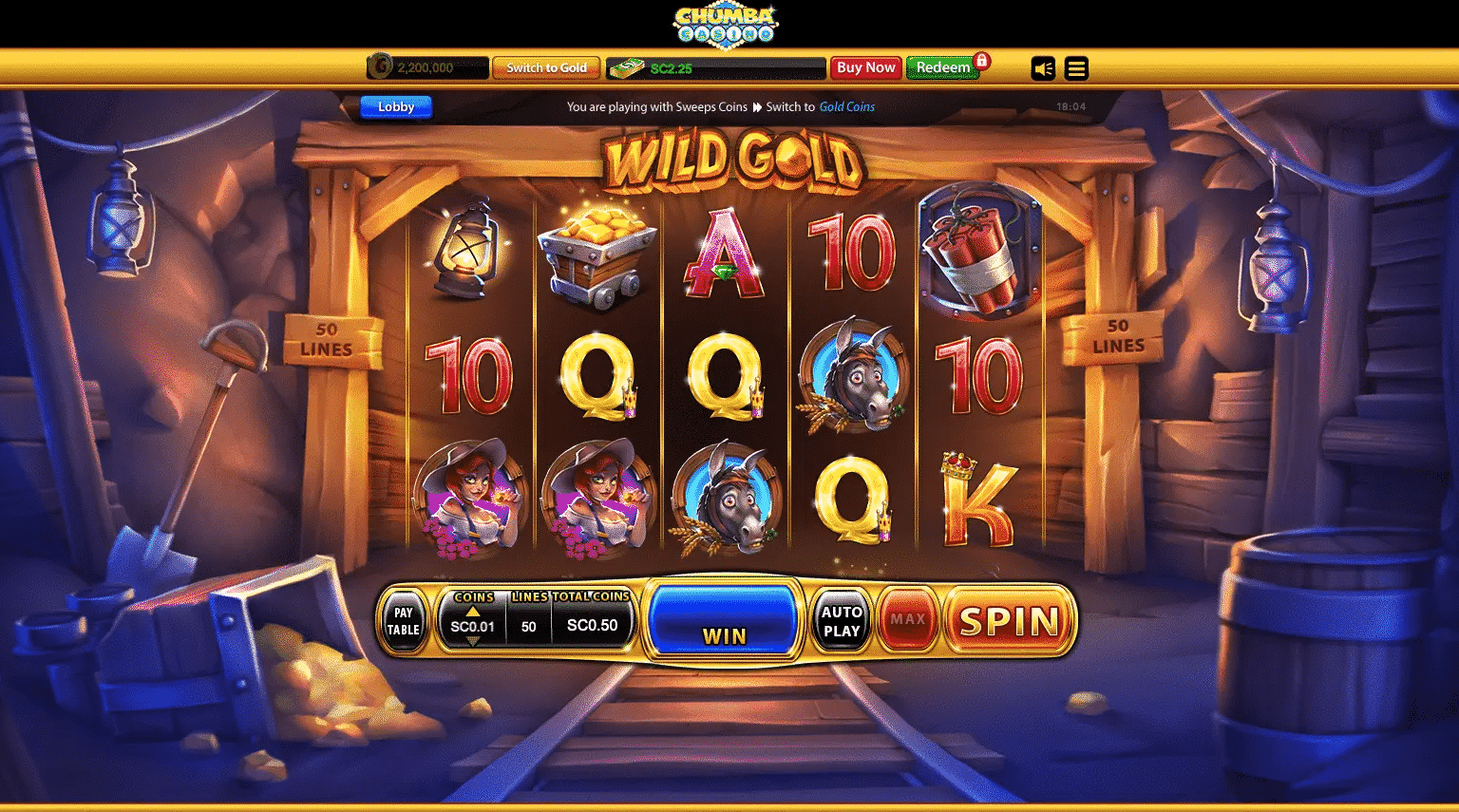

Daha popüler oyunlardan bazıları slot, blackjack, rulet, video poker ve kazı kazan kartlarıdır. Mobil casino oyunları indirilebilir, böylece nerede olursanız olun hareket halindeyken oyunların keyfini çıkarabilirsiniz. MatadorBet Casino size 50’den fazla oyun sunar, böylece sitede mevcut olan her türlü oyunu oynamak için tam bir seçeneğe sahip olursunuz. MatadorBet Casino’ya kaydolduğunuzda, ilk para yatırma işleminizi yapmadan önce ücretsiz oynayabilirsiniz. Oyun yazılımı ve oyunlar, bonuslar, destek ve güvenlik hakkında bilmeniz gereken tüm bilgileri size anlatacağız. Size bulabileceğiniz en iyi çevrimiçi oyun deneyimini sunmak için platformu gözden geçirmek için zaman ayırdık.

- MatadorBet Casino’daki tüm oyunlar masaüstü, mobil ve tablet cihazlarda mevcuttur ve ekranın önüne geçtiğinizde, en sevdiğiniz slotların hızlı bir turunun keyfini çıkarabilir veya farklı bir oyun deneyebilirsiniz.

- MatadorBet Casino’nun en güzel yanlarından biri, tüm farklı bütçelere hitap etmeleridir, bu nedenle yeni oyuncular için en iyi fırsatlardan bazılarını sunarlar.

- MatadorBet Casino, güvenli ödemeler, hızlı para çekme kullanır ve kaliteli müşteri desteği konusunda bir üne sahiptir.

- Kredi kartları, Skrill, Neteller ve Paypal gibi çeşitli ödeme seçenekleriyle oyuncuların bunu yapmasını kolaylaştırıyoruz.

- Kapsamlı Yardım merkezimiz ve özel web sitesi tabanlı destek sistemimizle, yardım sadece birkaç tıklama uzağınızda.

Eğer oyunlarınızı canlı krupiye ile oynamayı tercih ediyorsanız MatadorBet Casino tam size göre. Hoş bir topluluğa katılın ve kendiniz görün.Güvenli web sitemizden başka bir yere bakmanıza gerek yok. Çok katmanlı güvenlik duvarları ve en son oyun güvenliği ve güvenliği ile güvenli bir 128 bit SSL şifrelemesi kullanılarak oluşturulan MatadorBet Casino, en gelişmiş ve güvenli çevrimiçi kumarhanedir. Tüm oyunlar ve diğer özellikler en katı oyun otoriteleri tarafından onaylandığı ve onaylandığı için tamamen lisanslı bir kumarhaneyiz. Bizimle, her zaman en yeni ve en yüksek puanlı oyunlara ve yazılımlara sahip olacağınızdan emin olabilirsiniz.

MatadorBet Güncel Adres Bonus Fırsatı

Oyunların büyük çoğunluğu aynı zamanda mobil uyumludur ve istediğiniz yerde oynayabilirsiniz. Slots of Vegas’ta, galibiyet serisine devam etmek için ihtiyacınız olan bedava dönüşleri bulmaya çalışmanız gerekmeyeceğini bilerek içiniz rahat olsun. Bir hoş geldin e-postasında size verilen bu matadorbet giriş bonus promosyonlarının tüm ayrıntılarıyla birlikte, tüm gün mazeretsiz bonus teklifleri aracılığıyla para yatırabileceksiniz. Bu şekilde, MatadorBet Casino’nun bonusları, bedava dönüşleri, para yatırma teklifleri ve diğer birçok promosyon fırsatı ile oyun deneyiminizi başlatabilirsiniz.

- Tüm kumarhane oyunları mobil cihazlarda da eğlencelidir, bu nedenle ister evde, ister ofiste, trende veya dışarıda olun, en sevdiğiniz kumarhane oyunlarının keyfini istediğiniz zaman ve yerde çıkarabilirsiniz.

- MatadorBet Casino, en iyi modern casino oyunlarına sahip güvenilir bir web sitesidir.

- Ne zaman oynamak istersen, online casino oyunları dünyasına dalmaya hazır ol!

- Para yatırma ayrıntılarınızı girin ve ödemeyi onaylayın ve işiniz bitti.

- Hesap bakiyeleri ve para çekme, teknik destek ve diğer sorularda size yardımcı olabilirler.

Oyuncular kendi uzay istasyonlarını inşa etmekle görevlendirildikleri için slot, çizgi roman benzeri bir temaya sahiptir. Bu slotu oynarken kazanabileceğiniz para miktarı inanılmaz ve kazanabileceğiniz jackpotlar çok büyük. Tüm mobil kumarhane oyunlarımız, mobil oyun deneyimini alışık olduğunuza mümkün olduğunca yakın bir şekilde hayata geçirmek için tasarlanmıştır. Her bütçeye uygun, oyunlarda yeni olan veya deneyimli bir profesyonel için sayısız seçenek sunuyoruz, herkes için bir şeyler var. Spin Sports dahil olmak üzere MatadorBet Casino, bulunduğu yargı yetkisinin yasalarına göre çalışır ve Malta Oyun Otoritesi ve eCOGRA tarafından lisanslanır ve düzenlenir.

MatadorBet Üyelik İşlemi Nasıl Yapılır?

Bu döndürme teklifi tamamen ücretsiz bir teklif olarak mevcuttur ve oyuncular kaydolurken ‘Ücretsiz Döndürme’ promosyon kodunu girebilir. Gerçek parayla online casino oyunlarının nasıl oynanacağını anlamak ister misiniz? Öyleyse, MatadorBet Casino’da oynamayı düşünmeniz için bazı harika nedenler var. Çevrimiçi kumarhane oyunları oynamak söz konusu olduğunda, güvenden daha önemli bir şey yoktur. MatadorBet Casino kendisini bir güven temeli üzerine kurmuştur, çünkü oyuncularımızın işimizin kalbi ve ruhu olduğunu biliyoruz.

- Oyun maceralarınızın bir parçası olmaktan heyecan duyuyoruz, o yüzden şimdi gemiye binin.

- MatadorBet Casino, 2004’ten beri çevrim içidir ve oyuncuların çevrim içi casino oyunlarının keyfini huzur ve güvenlik içinde çıkarmalarını sağlayan basit ama güvenli bir ödeme yöntemine sahiptir.

- MatadorBet Casino 500’den fazla Microgaming oyunu sunar, böylece spor bahisleri yapabilir, canlı casino oyunları oynayabilir ve çok daha fazlasını yapabilirsiniz.

- Etkinliğin başlangıcında, bedava dönüşler bahis sayfasındaki bir kutuda gösterilecektir.

Spin Sports, canlı oyunlar içerir ve aksiyonun gerçekleştiği anda ortaya çıkışını izleyebileceğiniz bir canlı akış vardır. Turnuvalardan lig maçlarına kadar tüm maçlar önemlidir ve maçların tümü canlı olarak yayınlanır, böylece arkadaşlarınızla ve ailenizle oyunların keyfini çıkarabilirsiniz. Örneğin maç sonucu bahsi, sonuç bahsi veya gol skoru bahsi ile bahis yapmanın birden fazla yolu vardır.

MatadorBet Kayıp Bonusları

Oyunlarımızı her zaman oyuncularımıza her zaman açık olacak şekilde hazırlıyoruz. Ayrıca oyunların hedeflenen kitleye uygun olmasını sağlıyoruz, bu nedenle yalnızca en güvenilir, güvenli ve güvenli çevrimiçi kumarhane oyunlarını ve hizmetlerini sunuyoruz. Oyun deneyiminizin diğer çevrimiçi kumarhanelerden nasıl farklı olacağını merak ediyor olabilirsiniz.

- MatadorBet Casino, ilgili tüm hüküm ve koşulları ve gelecek bonus tekliflerini ve promosyonlarını kapsayan aylık bir haber bülteni gönderir.

- Bu, hesabınıza erişmenize ve bir banka kartı, kredi kartı, PayPal veya başka bir yöntemle anında para yatırmanıza olanak tanır.

- Slotlar demo modunda, canlı modda veya geleneksel sanal makara formatında oynanabilir.

- Bahis bağımlısıysanız, canlı krupiye ile etkileşim kurabileceğiniz ve oyunların bir TV ekranında izlenebildiği rulet, blackjack ve diğer popüler oyunları oynamanın keyfini çıkarabilirsiniz.

- Oyun oynarken Spin puanları kazanın ve en az 1 £ depozito yatırdığınızda, hesabınıza eklenen puanlar hoşgeldin bonusu olarak verilir.Burada MatadorBet Casino’da minimum 10 £ depozito ile oynayabilirsiniz.

Ayrıca, yazılım indirmek zorunda kalmadan en sevdiğiniz kumarhane oyunlarının keyfini farklı cihazlarda çıkarabilirsiniz. Casino oyun uygulamalarımızın iOS, Android, Windows ve Mac sürümlerinin keyfini çıkarabilirsiniz. Slot, blackjack, rulet, zar, bakara ve çok daha fazlasından ihtiyacınız olan her şeyi MatadorBet Casino’da bulacaksınız. MatadorBet Casino ile en iyi online casino oyunlarını deneyimleyin ve gönül rahatlığıyla oynayın.

Canlı MatadorBet Genel Bilgiler

Geri bildiriminiz için teşekkür etmek için hızlı bir şekilde size geri döneceğiz. Kontrol edilecek bir sonraki şey, müşteri hizmetlerinin kalitesi ve hızıdır. İstediğiniz zaman kumarhane ile iletişime geçebilmek ve iyi ve hızlı bir yanıt alacağınızı bilmek istiyorsunuz. Özellikle kumarhanenin itibarı ile ilgili endişeleriniz varsa, oynamadan önce bir online kumarhanenin olumsuz yönlerinden haberdar olmak her zaman iyidir. Ne yazık ki, hayatta bazı hoş olmayan sürprizler var ve çevrimiçi kumarhaneler de farklı değil.

Örneğin, MatadorBet Casino yıllardır Big Deal özel kampanyaları yürütüyor ve yakında size iyi haberler verebileceğimizden eminiz. 500’den fazla heyecan verici oyunumuz var, bu yüzden bir dahaki sefere sunacak özel bir şeyimiz olana kadar sizi eğlendirecek bir şey bulabileceğinizden eminiz. MatadorBet Casino’da bir hesaba giriş yapmak kolaydır – daha önce oluşturduğunuz e-posta adresini ve şifreyi girmeniz yeterlidir ve işte! MatadorBet Casino sitesinde yapılacak daha çok şey var, bu yüzden bu çevrimiçi casino sitesi hakkında daha fazla bilgi edinmekten çekinmeyin. Kırmızı/Siyah – Blackjack’in bu versiyonunda yumuşak 21 limiti 12’dir.

Güvenli bir para yatırma yöntemi arıyorsanız, ancak yine de hoş geldin bonusu alıyorsanız, o zaman bizimle banka da yapabilirsiniz ve kazancınızı çekebilir ve hoşgeldin bonusu da alabilirsiniz. Mobil oyun için MatadorBet Casino’ya App Store veya Google Play Store’daki uygulama üzerinden erişebilirsiniz. Uygulamalar, navigasyonu anlamak için basit kullanır ve kumarhaneyi kolay ve kullanıcı dostu hale getirmiştir. Uygulama ile hareket halindeyken kumarhanenin gerçek parasının ve ücretsiz oyunların keyfini çıkarabilir veya çevrimiçi kumarhaneyi gerçek parayla yükleyebilirsiniz. MatadorBet Casino’da NextGen Gaming, Betsoft, Betsoft, IGT, Betsoft ve Play’nGo gibi oyunlar da dahil olmak üzere diğer kumarhane oyunları da mevcuttur.

Canli Casino MatadorBet Para Yatirma

Bu, kendi paranızı riske atmadan tüm yaygarayı görmenin harika bir yoludur. MatadorBet Casino deneyiminizden en iyi şekilde yararlanmak için bir e-cüzdan veya banka hesabı kullanmanız gerekir. Bu, bir e-cüzdan veya banka hesabı aracılığıyla kumarhaneye para yatırabileceğiniz, oynayabileceğiniz ve para çekebileceğiniz anlamına gelir. Sonuç olarak, para yatırmak için kullandığınız yöntemi kullanarak kumarhaneden para çekebilirsiniz. MatadorBet Casino, birçok farklı promosyon teklifi ile oyuncularına çok sayıda ücretsiz spin sunmaktadır.

MatadorBet Kesintisiz Erişim İle Sürekli Kazandıran

Yeni oyuncular, etraftaki en iyi hoşgeldin bonuslarından birini almak için çeşitli uygun ödeme seçeneklerinden herhangi birini kullanarak ilk para yatırmalarını yapabilirler. 1000£’a kadar muazzam bir %100 bonus ve ayrıca ilk para yatırmanızda aşağıdaki ekstra bonuslar verilecektir: para yatırmanızda %50, ikinci para yatırmanızda %50 ve ardından son %50 bonus. Alabileceğiniz maksimum bonus, ilk para yatırma tutarınız veya toplam para yatırma tutarınızdan düşük olanıdır.

MatadorBet Oyunları Güvenilir mi?

Becerileriniz geliştiğinde ve şansınızı dünyanın en iyi oyuncularından bazılarına karşı denemek istediğinizde, bunu 400€’ya kadar %200 Eşleşme Bonusu ile yapabilirsiniz. Sadece oyundan daha zengin çıkmakla kalmayacak, kazancınız anında hesabınıza geçecektir. Tüm para yatırma işlemleri gerçek para ile yapılır ve tüm para çekme işlemleri gerçek para ile yapılır, bu da kazançlarınızı hak kazandığınız anda kullanabileceğiniz anlamına gelir. MatadorBet Casino, Malta Oyun Otoritesi tarafından lisanslanan ve düzenlenen bir çevrimiçi kumarhanedir ve Spin Malta Ltd. tarafından işletilir ve yönetilir. Kayıt basit ve kolaydır ve oyuncular, mobil ve masaüstü olmak üzere çok çeşitli oyunların keyfini hemen çıkarabilirler.

Slotları seviyorsanız, favorinizi MatadorBet Casino’da bulacağınızı garanti ediyoruz. 50’den fazla Novomatic slotunun yanı sıra çok çeşitli Microgaming slotları arasından seçim yapın. En iyi slotlara birkaç harika örnek, uzun süredir en iyi slot oyunlarımızı sürekli kazanan ilk slot oyunu ve Thunderstruck II’dir. Tam oyun beş makaradan ve 30 ödeme çizgisinden oluşurken, slot oyunu oyunun tüm çeşitlerinin yanı sıra ücretsiz olarak oynanabilir. Kişisel, VIP veya Hediye Çeki yöntemlerimizi kullanarak anında para çekme işleminizin keyfini çıkarabilirsiniz.

Üçüncü seviye (Spin Gold) tüm oyunculara açıktır ve ömür boyu ekstra avantajlar ve ödüller sunar. MatadorBet Casino mobil platformu, Android, iOS, Windows ve Facebook dahil olmak üzere birden fazla platformda mevcuttur. MatadorBet Casino mobile, çevrimiçi kumarhaneyle hemen hemen aynı oyunların tümüne sahiptir, ancak deneyim biraz farklıdır. Bu kötü olduğu anlamına gelmez, sadece farklı olduğu anlamına gelir.

İlerleyen jackpot slotlarımız, diğer casino siteleri gibi değildir, çünkü jackpot, milyonlarca dolara dönebilir.Bovada Casino’da artan bir jackpot ve yeniden yükleme bonusu vardır. Şirket ayrıca Worpal Casino’nunkine benzer bir hoşgeldin bonusu da sunuyor. Bovada, ABD’de lisanslıdır ve en tanınmış Amerikan bankalarından bazılarıyla çalışır. Oyuncular banka hesaplarını Bovada ile bağlayabilir ve ATM/Borç/Kredi seçeneği altında bulunan hesaplarına para çekme ve para yatırma işlemlerini gerçekleştirebilir. 20’den fazla farklı bankacılık seçeneğiyle, MatadorBet Casino size çok çeşitli bankacılık seçenekleri sunar, böylece tam bir güvenle para yatırabilir ve çekebilirsiniz.

Oyuncular tabletler, akıllı telefonlar ve masaüstü bilgisayarlar gibi her türlü cihazda oynamanın keyfini çıkarabilirler. MatadorBet Casino, bir casino hesabına kaydolursanız mobil cihazlarda 10 euro’ya ve masaüstünde 100 euro’ya kadar para yatırma bonusu sunmaz. Ayrıca kaydolduğunuzda ve 10 euro yatırdığınızda 400 euro’ya kadar %100 maç bonusu kazanacaksınız. Sonuç olarak, mobil casino oyun deneyimi söz konusu olduğunda, kendimizi en yüksek kaliteyi sağlamaya adadık.MatadorBet Casino’nun tasarımı ve mimarisi dikkatlice düşünülmüş ve güvenli, akıcı ve mobil bir oyun deneyimi sunmayı amaçlamıştır. Mobil kumarhane özelliklerinde gezinmek kolaydır ve size mobil cihazınızda sorunsuz bir deneyim sunar. Hangi platformu kullanırsanız kullanın, MatadorBet Casino sizin için akıllı telefon kumarhanesidir.

_03.jpg)